August Premiums Finish at $1.2B for Florida's E&S Market

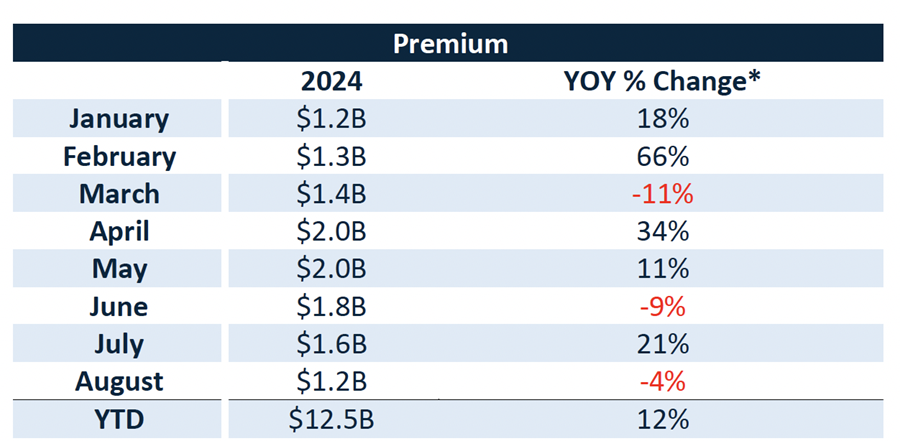

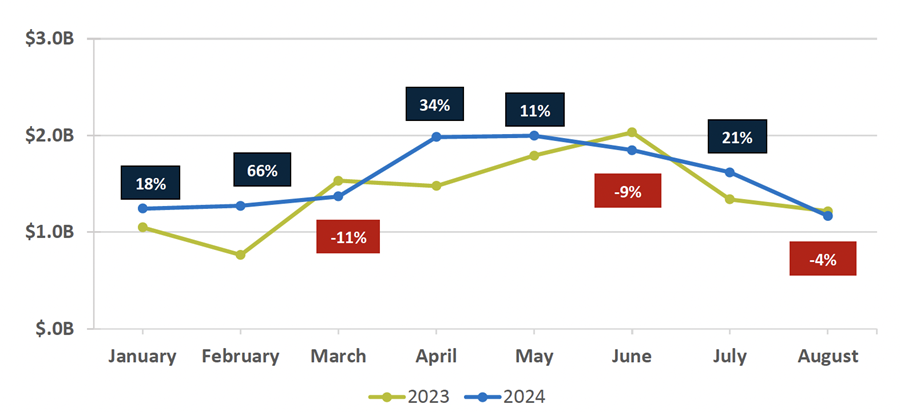

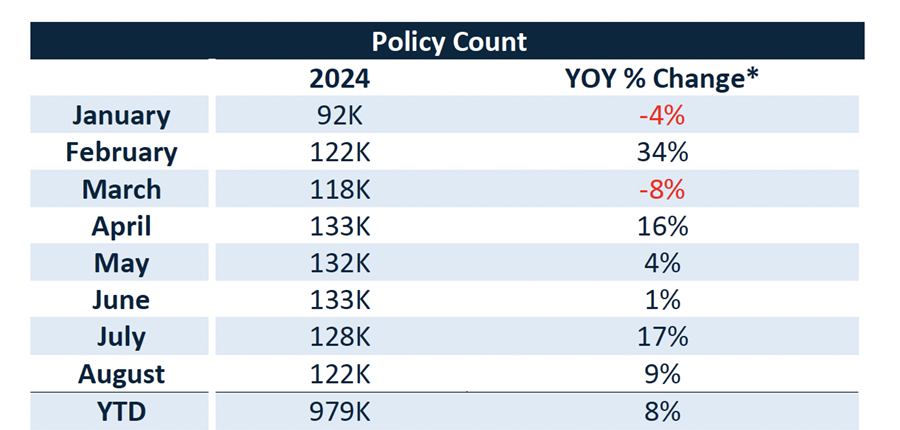

Florida's E&S market remains notably variable as August premium totals peaked at $1.2 billion, a 4% decrease from August 2023. Policy count, however, showed a 9% increase over August 2023, reaching a total of 121,576.

Year-to-date, annual premium reached $12.5 billion through August, representing a 12% increase compared to the same period in 2023. Policy count grew 8% to over 979 thousand.

Monthly Premium Breakdown

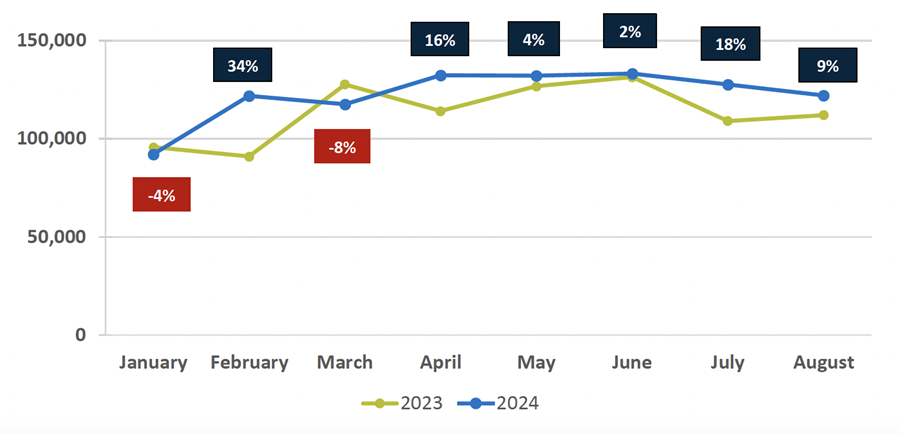

Monthly Policy Breakdown

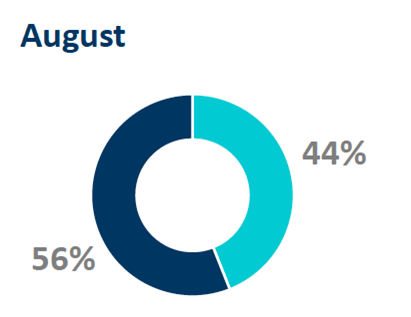

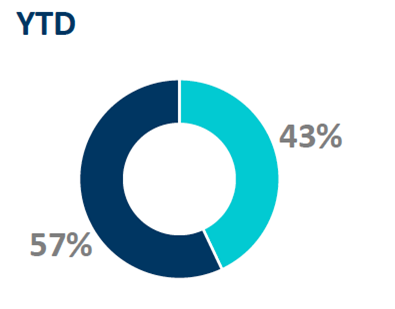

New Business and Renewals

New business and renewal ratios showed little movement in August, with new business at 44% and renewals at 56%. Year-to-date ratios remained consistent at 43% and 57%, respectively.

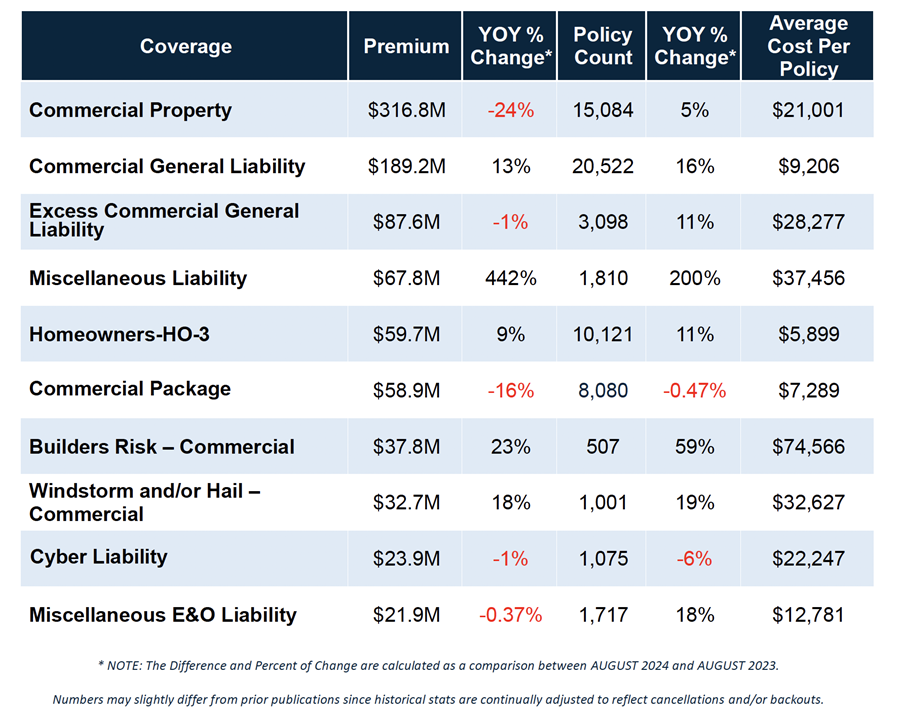

Top Coverages in August

Commercial Property remains the dominant E&S coverage in Florida at $316.8 million in premium. This figure represents a 24% decrease from August 2023, while policy counts showed a 5% increase over the same period.

While other coverages, including Excess Commercial General Liability, Commercial Package, Cyber Liability, and Miscellaneous E&O Liability, experienced year-over-year premium declines, policy count increased in all coverages except Commercial Package and Cyber Liability.

Miscellaneous Liability stood out with substantial growth, increasing premium by over 400% year-over-year to $67.8 million and policy count by 200%.